Where is the most affordable place to live in the UK?

8 Apr 2021How family can help you get a mortgage

14 Mar 2022Saving up for a deposit requires commitment, effective budgeting, and financial planning. But once renters are in the position to buy a property, how much should they expect to budget for their mortgage repayments, versus the average rent in their area.

RM Mortgage Solutions have analysed the monthly mortgage repayments for properties across UK towns and cities, comparing this to the median monthly rent in each area. They’ve highlighted the change in additional costs when comparing different loan to value ratios.

The towns and cities where a mortgage has the lowest impact on monthly expenditure

In some areas of the UK, a mortgage can make a minimal change to the monthly expenditure that you’d expect when renting. Savvy buyers may even be able to reduce their monthly expenditure while investing their income into their property.

Blackpool

From this research, residents in Blackpool are the only people in the country who can purchase a property with a 10% deposit and see mortgage repayments 1.7% lower than the average rent for the area. Residents here can not only invest in their property rather than rent, they can reduce their expenditure doing so.

Burnley

The second town from Lancashire to feature, Burnley comes in second. Residents looking for a home in this area will see a rise of just 0.3% in the cost of monthly mortgage repayments versus rental expenditure, with a 10% deposit. Mortgage repayments would become 5.3% lower than the £450 median rent for the area if home buyers put forward a 15% deposit.

Gloucester

Moving into the South West of England, Gloucester is the first city on the list and the Southernmost area in the top five. Homebuyers here can expect to see their average outgoings rise by just 6.6% when moving from a rental property to owning a home – a bargain when homeowners in nearby Cheltenham face an increase of 73.5%.

Preston

Back in Lancashire, soon-to-be homeowners in the city of Preston will only spend 9.3% more per month on mortgage repayments than rent, with a 10% deposit. Increasing the deposit amount to 20% would reduce average payments to -2.8% the average median rent of £550.

Newcastle upon Tyne

Newcastle upon Tyne rounds up the top five areas where home buyers will see the lowest change in monthly expenditure from rent to mortgage repayments. Buyers in this historic city will need to, on average, budget for a 9.6% increase in this cost, when putting down a 10% deposit for a property. Expenditure on mortgage repayments will actually reduce to -2.6% of the £695 median rent with a 20% deposit.

The towns and cities where a mortgage increases monthly expenditure the most

In some areas of the UK, property prices (and monthly mortgage repayments) have risen far above the average rental costs. If you can afford to buy in a city such as London that’s experiencing this, keep these cost differences in mind when breaking down expenditure after purchasing a property.

London

London is the priciest area for renting in the UK, with rent averaging £1,430 per month across all Boroughs. People looking to purchase a property in the capital will also see the largest increase in this monthly expenditure. On average, homebuyers face an increase of 141.3% in rental costs with a 10% deposit or an increase of £2,020 per month.

Cambridge

The second area where mortgage repayments increase monthly expenditure the most is Cambridge. The average mortgage repayment for a 10% deposit is an increase of 137% above median rental costs of £895.

Winchester

Winchester, a highly desirable cathedral city in Hampshire, places third. Rent here costs an average of £975 per month, but 10% LTV mortgage repayments increase this figure by 112%.

Stratford-on-Avon

Stratford-on-Avon has the lowest average rent of the top five, at £775 per month. However, home buyers will see an average increase of 99.9% in expenditure when purchasing here.

Chichester

Rounding off the top five areas where a mortgage increases monthly expenditure the most, is Chichester. Located on the South coast, this historic city costs £900 per month for median rent. However, a mortgage increases this expense by 98.2% when soon-to-be homeowners purchase here, with a 10% deposit. Reasons for the increase in additional costs when purchasing here could be due to the large number of vacant second homes in the city, which inflate the property market but don’t affect demand in the area for renting.

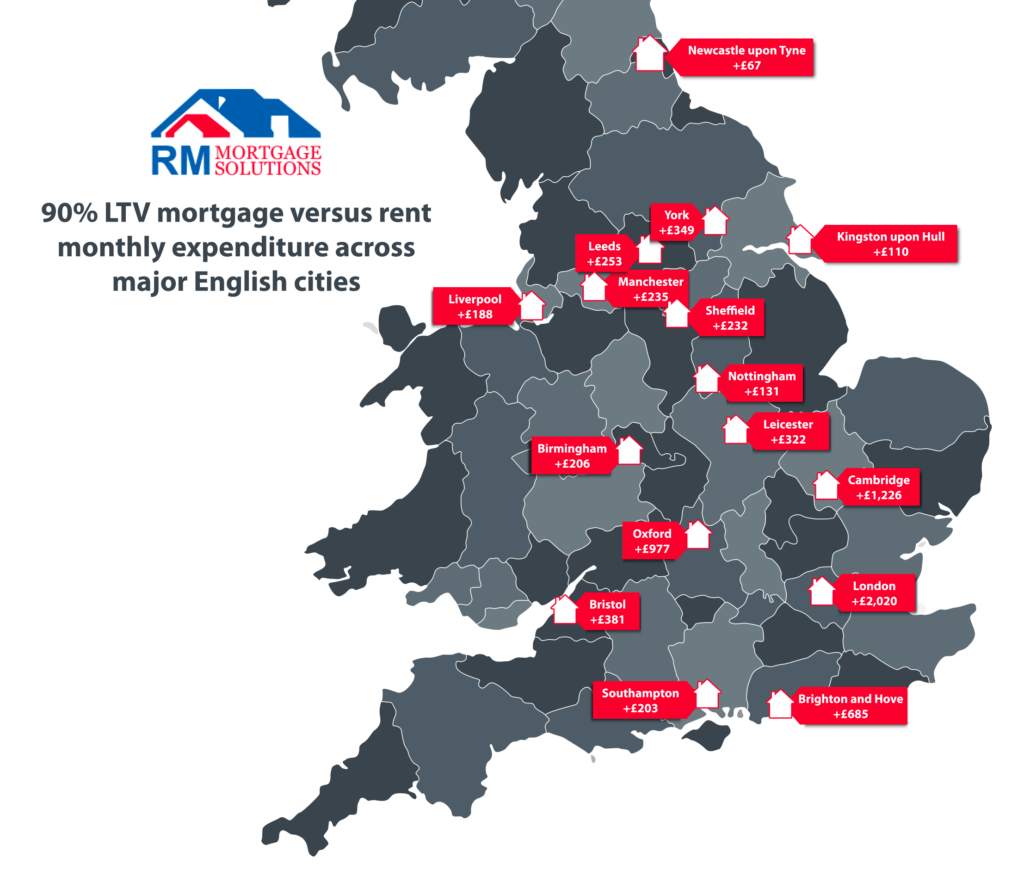

The cost of a mortgage versus rental monthly expenditure across major English cities

The team at RM Mortgage Solutions have focused on the potential expenditure differences that you may see in major English cities.

Overall Newcastle upon Tyne is the most affordable major city for buying over renting. When comparing mortgage calculations for the average house here and median rent, prospective home buyers will spend just £67 more per month on a 10% LTV mortgage versus rent.

Birmingham is an excellent choice for property buyers looking to experience the bustle of city life. While London buyers may need to budget 141.3% more than their current rent, buyers in Birmingham may only pay 28.7% more than average rent in the area. RM Mortgage Solutions are a Birmingham based mortgage broker and advisor. They have a thorough knowledge of the market and can advise on the most suitable mortgages for those looking to settle in the UK’s second-largest city.

About RM Mortgage Solutions Ltd

RM Mortgage Solutions are a firm of mortgage brokers based in the Birmingham area. They provide whole of market advice to individuals on UK mortgages, remortgages, buy to let, protection and general insurance through carefully considering the client’s situation, needs, and priorities before making appropriate recommendations. Within their mortgage advice, they offer first-time buyer mortgage and home mover mortgage advice. The team at RM Mortgage Solutions also offer advice on protection and refer you to an advisor who can assist with equity release. Enquire for further information.

RM Mortgage Solutions Ltd is authorised and regulated by the Financial Conduct Authority and is entered on the FCA register under reference 911918.